Abstract

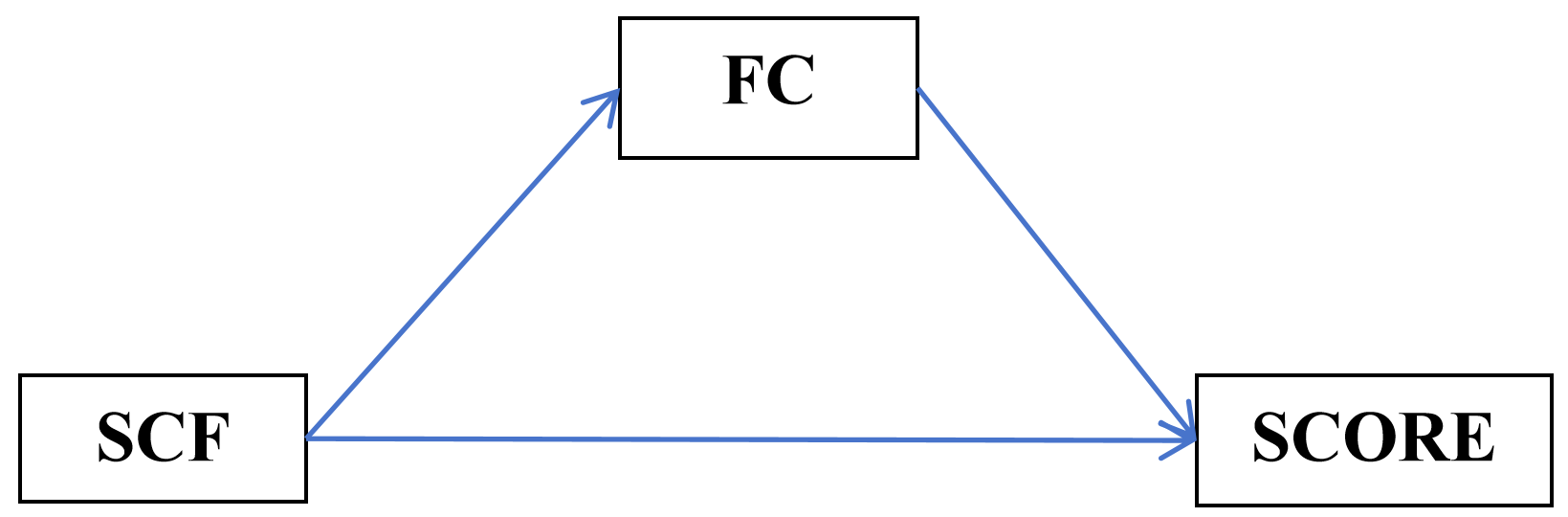

With the rapid development of the new energy vehicle (NEV) industry, supply chain finance (SCF) has become one of the key factors promoting the prosperity of this industry. Based on in total 884 samples, this study investigates the impact of SCF on the integrated business performance of NEV enterprises. Through empirical analysis, it is confirmed that SCF significantly and positively affects the integrated business performance. In addition, the results of the mediation effect test indicate that by alleviating financing constraints of small and medium-sized enterprises, SCF enables the improvement of firms' overall business performance. These findings provide new insights to NEV enterprises' financing and reference for policy-makers.

Keywords

new energy vehicles

supply chain finance

integrated business performance

intermediary effect

Funding

This work was supported by the Project of Educational Science Planning of Guangdong Province under grant number 2022GXJK085 and the School-level Research Project of the Software Engineering Institute of Guangzhou under grant number KY202307.

Cite This Article

APA Style

Wang, C., Zhou, S., Ye, J., Hu, H., Wu, X., He, Z., & Ding, H. (2024). The Impact of Supply Chain Finance on Integrated Business Performance of New Energy Vehicle Enterprises. IECE Transactions on Internet of Things, 2(3), 63–73. https://doi.org/10.62762/TIOT.2024.262824

Publisher's Note

IECE stays neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Institute of Emerging and Computer Engineers (IECE) or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Submit Manuscript

Edit a Special Issue

Submit Manuscript

Edit a Special Issue